NFL Star Saquon Barkley: Building an Empire Beyond Football Through Smart Investing

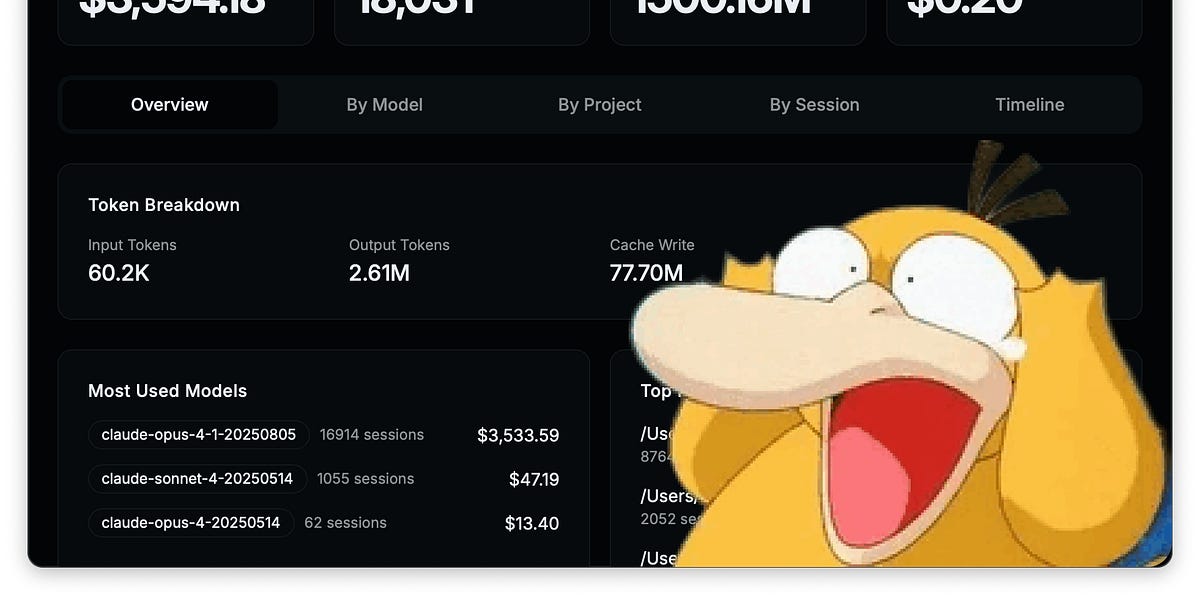

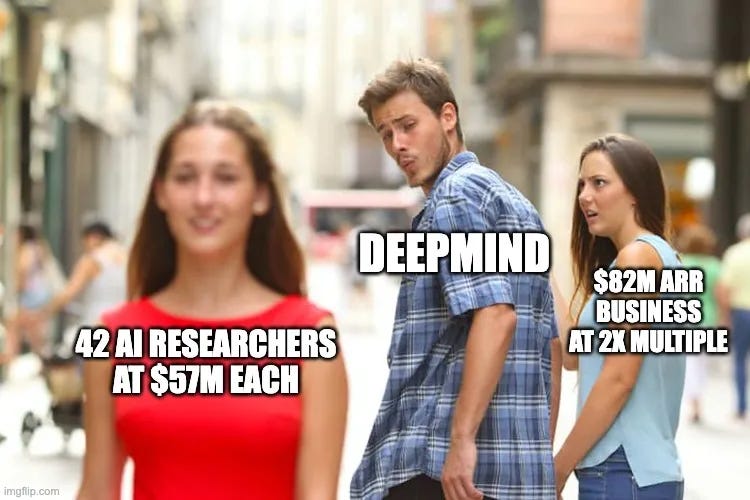

NFL star Saquon Barkley isn't just cashing checks and smiling for the camera; he's building an empire. Driven by a unique financial paranoia stemming from childhood financial insecurity, he strategically invests his earnings, shunning typical athlete endorsements for equity in high-growth tech startups like Anthropic and Anduril. He actively participates in these companies' growth, going beyond a simple investment to become a true partner. Barkley's approach is a calculated risk, leveraging his platform and influence to secure significant returns, while prioritizing long-term stability for his family's future.