India's AI Ambitions: A David vs. Goliath Struggle Against US Tech Giants

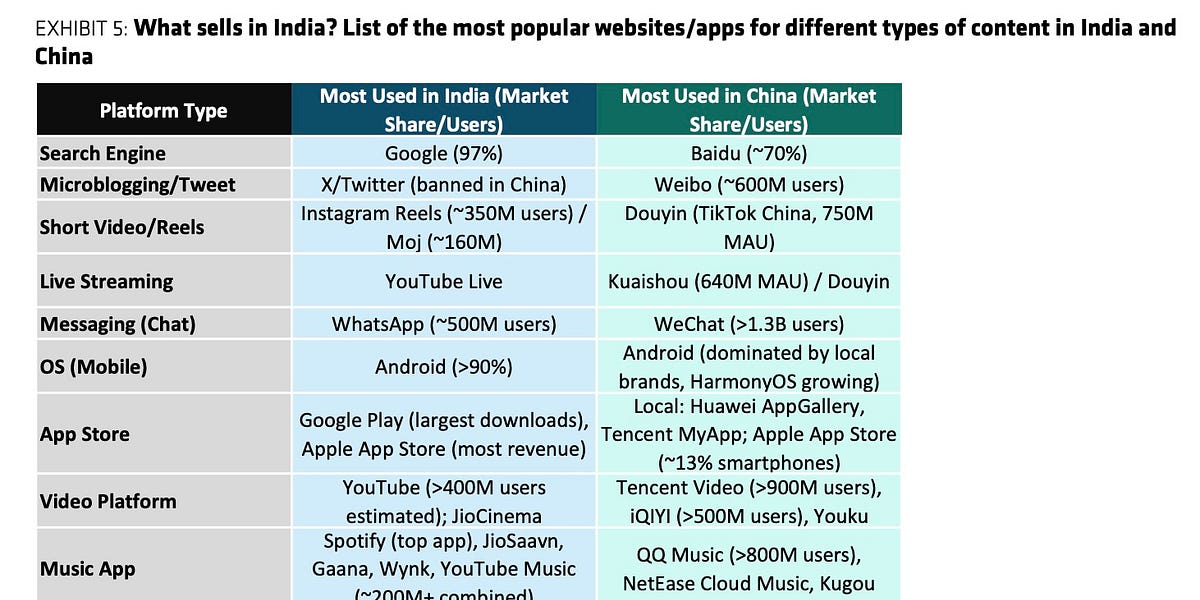

While India boasts ambitions of AI sovereignty, its fledgling domestic AI sector faces a daunting challenge: a massive funding gap, regulatory inconsistencies favoring foreign tech giants, and the unchecked expansion of US tech behemoths. Companies like OpenAI and Perplexity AI are aggressively undercutting Indian startups like Sarvam AI and Ola Krutrim with aggressively low prices, leveraging existing user bases to lock in market share. Bernstein analysts warn of misplaced enthusiasm surrounding the entry of these giants, highlighting a fundamental power imbalance. India's AI development is hampered by insufficient funding (US $471B vs India's $11.29B between 2013-2024), regulatory double standards favoring foreign companies, and a strategic risk of becoming a mere digital marketplace rather than a creator of AI technology. This leaves India's AI aspirations significantly threatened.

Read more